A solid strategic measure in companies must address various factors related to financial administration and control, as well as the management of unforeseen situations and risks.

Debt management is a fundamental element in the financial strategy, since this process allows organizing and executing strategies in reference to the company’s obligations to maintain balance.

Aspects in debt management

There are several aspects that can be included in the debt management strategy. Currently, there are innovative tools and processes and one of them is Factoring, a financial tool that can positively impact cash flow.

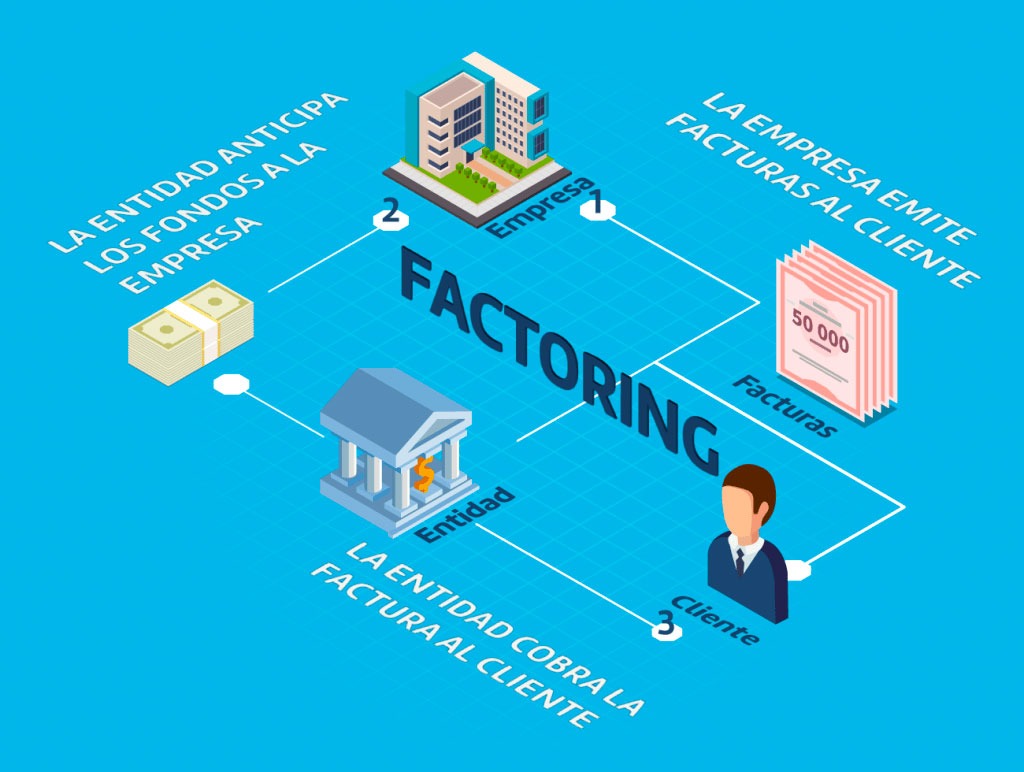

Factoring is a financial process in which a company sells its accounts receivable (invoices pending payment) to a financial institution or a Factoring company in exchange for cash.

A financial strategy must include aspects such as planning, visibility and balance, fiscal behavior, among others. However, when addressing a company’s debt management, it is possible to include Factoring as a tool for managing financial obligations, given its multiple advantages:

Immediate liquidity: Immediate cash is obtained from accounts receivable, which facilitates investment, payments and operations with greater effectiveness.

Risk reduction: Protects the company from fluctuations in the customer portfolio and non-payment.

Improvement of collection management: Time and resources are saved in collection management, since the Factoring entity is in charge of carrying out this process.

Cost reduction: Additional costs associated with traditional credits, such as high interest rates, are reduced, in addition to the savings it generates in process resources such as managing collections and traditional procedures.

Companies of any size or sector can evaluate their situation and needs to consider Factoring as a financial tool within their strategy. This will be useful especially if your needs include obtaining cash more quickly, if you had unexpected expenses, if you have invoices with long payment terms or if you are looking for financial support.