Si haces parte del área de Abastecimiento, con seguridad has vivido un periodo de estrés por realizar un cierre de presupuesto anual.

A pesar de que el área Financiera todos los años anticipa el correo o envía alertas informativas y aunque se haya definido en el cronograma que el 31 de octubre es el cierre, la realidad es que hasta la tercera semana de noviembre realmente se cierra este ejercicio.

El afán de todas las áreas es poder incluir lo máximo posible, la “carta al niño dios” que finalmente el área de finanzas empieza a cortar inicialmente en ejercicios democráticos y en la recta final en comités decisorios donde simplemente se informa lo que fue considerado.

Cronograma para el cumplimiento de metas

Este presupuesto permanece rígido durante la ejecución del año y en el mejor de los casos con controles presupuestales mensuales que envían a las áreas con los indicadores de cumplimiento.

Ante cada solicitud de compra o gasto se debe explicar al área que aprueba lo que fue considerado en el presupuesto para poder proseguir con los procesos.

Este ejercicio es bastante desgastante y genera ciertas barreras entre los funcionarios y hay cierto desinterés por la revisión de presupuestos.

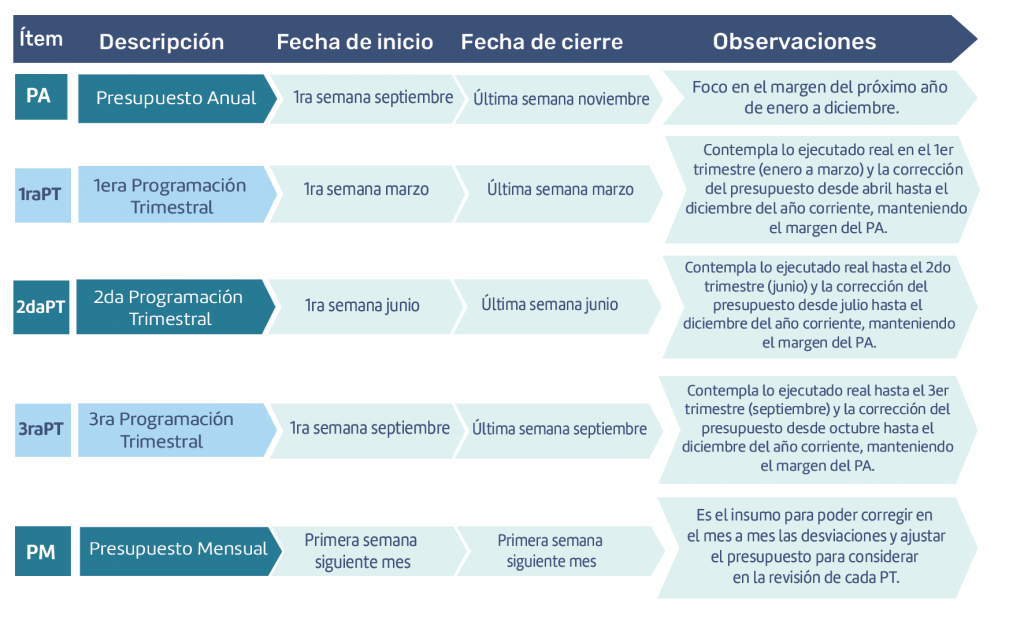

Etapas del control de presupuesto

El control de presupuestos finalmente parte de una cultura empresarial y no puede ser un ejercicio coyuntural que avoque a la organización, por el contrario, debe ser un proceso estructural que debe permear a todos los colaboradores tengan muy presentes la consecución de las metas estratégicas definidas.

A continuación, se detallan algunas sugerencias de buenas prácticas para hacer del ejercicio presupuestal de manera orgánica y constante durante el transcurso del año, haciendo del presupuesto una tarea dinámica y participativa:

Como aspecto importante en el control de presupuestos, siempre se debe considerar una bolsa de imprevistos cuya gobernabilidad parte de la materialización de la matriz de riesgos, en cuya gestión deben existir los planes que permitan su debida gestión y el impacto, posterior al análisis de sensibilidad de todos los escenarios presupuestados, se debe tener presupuestados mes a mes y revisados en cada ejercicio (PT).

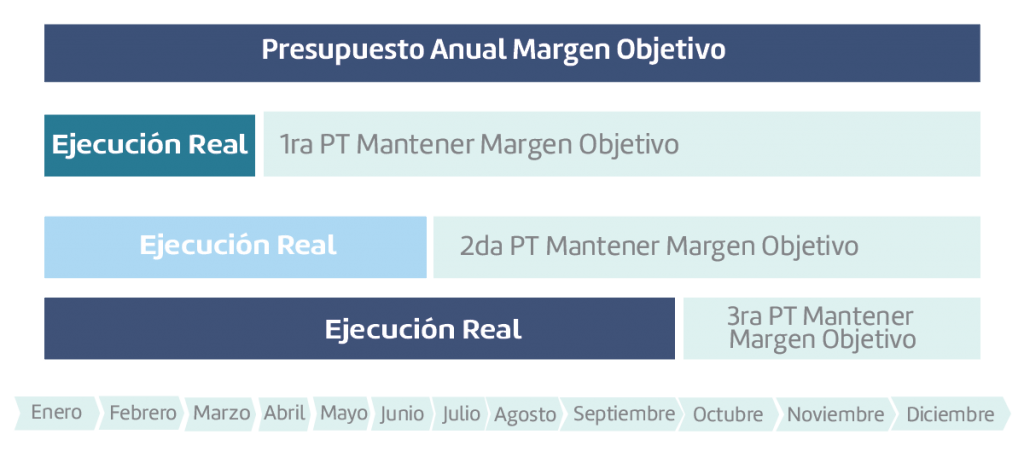

Finalmente, los márgenes se deben mantener con respecto a lo estimado en el Plan Anual y cada revisión presupuestal en cada trimestre (PT) debe mantener el margen objetivo al sumar el valor real más lo presupuestado para el restante del año, según el mes que corresponda. Esta metodología hará del ejercicio presupuestal un actividad dinámica y constante que implica compromiso y revisión de los involucrados.