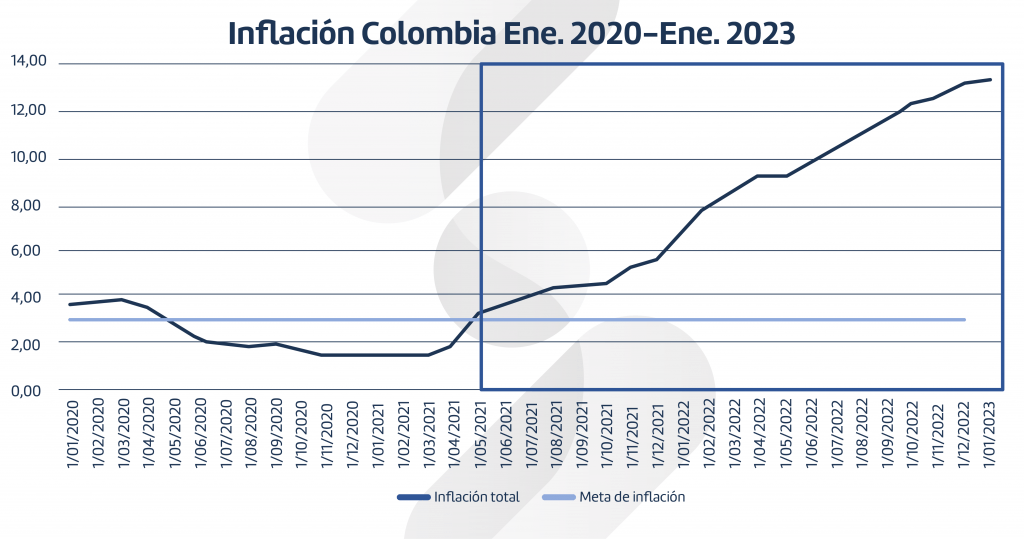

Despite the fact that in recent months there has been a notorious increase in the annual variation rate of the CPI (inflation) in Colombia, which means the generalized and sustained increase in the prices of goods and services representative of household consumption in a country, Banco de la República as an autonomous entity has the capacity to generate policies to control the inflation that is occurring, one of them is to increase the interest rate.

In this article we will discuss inflation, interest rates and the viability of acquiring credit at this time.

A guide to understanding inflation in times of debt

We already have a definition of inflation, however, in order to understand this definition, we will give an example: let's suppose that in 2020 with $2,000 we could buy 10 loaves of bread, and in 2022 for $2,000 we could only buy 4 loaves of bread.. This means that, for the same $2,000, fewer loaves of bread can be purchased than in previous years, i.e. inflation reduced the value of the currency over time.

Banco de la República, as the central bank, is an autonomous institution, which means that it has the capacity to make decisions freely without being subject to other government agencies. The bank's functions are to issue and manage the legal currency, as well as to control the country's monetary, credit and exchange system. The Board of Directors sets an inflation target, which refers to consumer price inflation. This target is set with data from the National Administrative Department of Statistics (DANE), where the variation of the consumer price index (CPI) is measured.

How to reduce inflation?

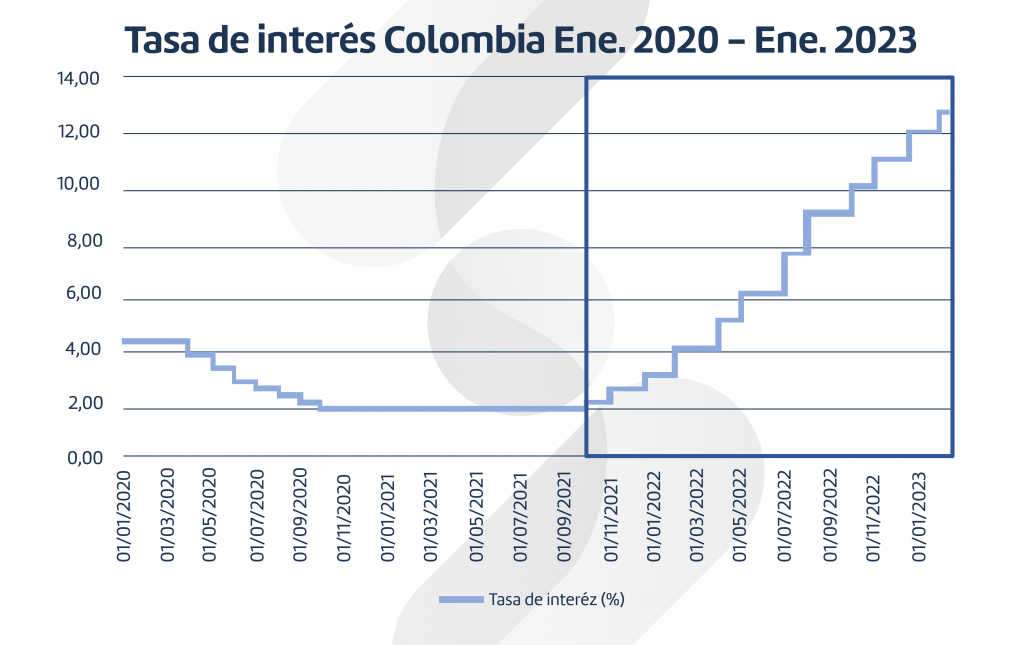

In order to reduce the inflation that is occurring and with the function that the Banco de la República has in the credit system, it is decided to use monetary policies by increasing the interest rate, thus generating that commercial banks (entities in which we normally have bank accounts) can increase the interest rate on credits requested by their clients.

The effects that Banco de la República expects with the increase in the interest rate is to stimulate savings and discourage credit, as well as to decrease the demand for products, causing in turn a decrease in inflation, because the lower the demand, the lower the prices. It is clear that these effects do not occur immediately, but are reflected over time.

For the above reasons, one should be careful if one wants to acquire credit at this time despite the high interest rates that may be charged.. However, there is still a good opportunity to save and invest with the money at your disposal. One of them is the CDTThe interest rate increases the yield to be received as the interest rate increases. However, when saving and investing, care must be taken to avoid generating side effects in the economy.