Despite a devastating pandemic, several positive developments have emerged in the Latin American energy sector. The price of renewable energy and related technologies, such as battery prices, are at all-time lows. Governments' push for carbon neutrality is helping to generate the global energy transition. However, challenges remain. The region's dependence on China creates friction to increase the value chain, COVID-19 has been giving up ground gained in employment for decadesThis has led to millions of Latin Americans living in poverty, exacerbating social crises and postponing major infrastructure projects that would allow a change in the dynamics of the sector.

The good: stable and increasing prices and new opportunities in renewables

There is a strong consensus among Latin American governments and investors on the need to reduce carbon emissions.

An example of this is ECOPETROL. With its SosTecnibilidad program, the Colombian state-owned company seeks to contribute and generate value to society through innovative and technological solutions to promote economic, social and environmental development. The net carbon emissions for ECOPETROL according to its strategic plan of zero are for 2050.

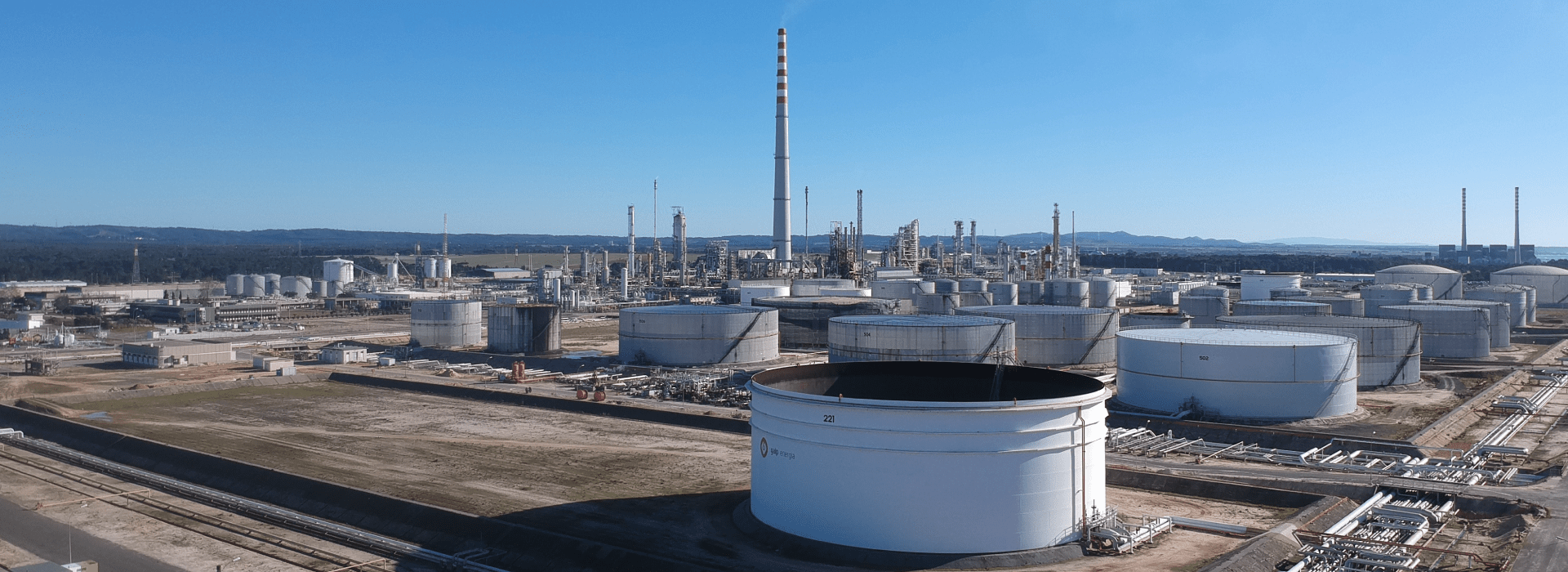

The increase in the price of oil and other raw materials in the Oil & Gas sector, together with the efficiencies derived from periods of crisis and austerity in previous years, has allowed companies to achieve operational efficiency and better operating margins.

These liquidity surpluses, coupled with lower financing rates, are being used by companies to invest in their installed capacity.The company has also invested in new technologies and, in some cases, in investments to achieve a definitive energy transition in Latam.

Proof of this is that two of the countries with the highest wind power generation were Argentina and Brazil. Brazil, Chile, Peru and Mexico stand out for offering the lowest prices in solar photovoltaic auctions.

Average price of solar and wind projects in USD, from recent auctions in 6 Latin American markets. [*]

The bad: social crisis in local communities

With the region having the highest unemployment in a decade and 45 million people living in poverty, voters are expected to give priority preference to social investment policies, beyond large and costly energy generation projects leveraged with public resources. Social frustration in the regions would mean that existing and new projects would require more fiscal transfers to stay in the communities for their support.

In Mexico, for example, there has been evidence of local communities protesting against wind farms in Oaxaca, arguing excessive noise and seepage of polluting material from the turbines. In Guyana, 9 billion barrels were discovered and there is ongoing pressure to renegotiate extraction terms with Exxon to employ as many local people as possible throughout the development of the project from construction to operation.

Another recent example is Colombia, where we have seen how some companies have had to cease their activities due to social protests with road blockades. To secure new and existing developments in the long term, it is vital that both companies and local state authorities are able to dialogue and understand the expectations of local communities. In this way, vital feedback can be received on the type of investment and support the local community expects to receive. This dialogue will generate local readiness and support.

The downside: few value-added projects and dependence on China.

In Latin America, countries such as Brazil continue to impose 65% tariffs on some battery components, making large battery manufacturing projects unfeasible.

Chile, Argentina and Bolivia that together contain 58% of the identified lithium reserves, nor have they been able to develop assets for battery processing.which would allow them to move up the value chain. Thus, the Lilpi project, which was intended to become the first commercial lithium processing plant, was cancelled by the government in 2019 due to protests from the local community of Potosi.

What has continued to happen in Latam countries is the continuous export of this type of raw materials, where China alone is responsible for receiving between 50% to 70% of the Lithium generated worldwide along with refined cobalt. China also controls between 85% to 90% of rare earths, which are vital for all types of electronic products.

Given that China produces 63% of the world's lithium batteries, in addition to 70% of graphite, one initiative that would be easily enforced by China is to impose taxes or restrictions on these goods, which would impede the development of essential renewable energy products. Thus, occurred with Japan when China restricted its exports of rare earths for 50 days causing the prices of these raw materials to increase by 350%. During 2021, it is likely that China will continue to impose restrictions on the export of these raw materials to the USA because of the tripartite conflict between the USA, China and Taiwan. For the USA these elements are vital for the manufacture of armaments.

Latin American countries are increasingly being forced to take sides between China and the United States. Choosing one or the other has implications that can contain supply chain disruptions from frictions and obstacles from the unselected side.

In addition to the above, Latin Americans are facing with greater dynamism another "ugly" factor and that is the rise of populist leaders. Brazil, Mexico and Argentina already have such a leader, while the same could happen in the upcoming elections in Peru and Colombia. The presidential actions of such leaders diminish investor confidence and impede a more open, affordable and competitive development of the energy market.

Growth in 2021 in consumer, air travel, commercial and industrial points to sustained growth by Latam energy. Given the fiscal gap of Latin American governments, they cannot afford to invest in the expansion of their energy capacity for the time being. However, opportunities abound in Latam for the development of new private energy projects. It is crucial for their effective development to navigate these challenges with careful due diligence that allows to read the macroeconomic and political climate in addition to the project's merits.

[*]Own elaboration and from the related reference.

[**]Taken from English:

Author: Arthur Deakin

Published in : February 28 of 2021

At Energy